Can Amazon and Apple revive tech stocks?

The tech-heavy Nasdaq index has been hit hard as losses in mega-cap tech companies have raised concerns over sluggish economic growth.

Earnings season Q3 is in full swing and although there have been some winners, such as Netflix, some of the world’s biggest tech companies have missed crucial revenue targets.

Alphabet (Google) and Microsoft (MSFT) reported dismal earnings, dragging the Nasdaq down. Meta Platforms, the parent company of Facebook, also reported a poor quarter.

Become a better trader – Join our webinars

There’s still hope for a recovery in the Nasdaq as two titans of the tech world, Amazon and Apple will release their earnings on October 27

Today, look at both Apple and Amazon to find out whether each stock is a buy, sell or hold.

Apple – the darling of Wall Street

You don’t get to be the world’s most valuable company without a sound business strategy and products. Apple is a company that has left other tech rivals in the dust.

AAPL shares have been remarkably resilient despite the massive tech selloff, sharply outperforming other FAANG rivals (Facebook, Apple, Amazon, Netflix, and Google, most of which are all down from 26% to 28% this year.

Apple has an eye-watering market valuation of $2.4 trillion, that’s $500 billion more than Microsoft, $1 trillion more than Google, and nearly double the size of Amazon.

All eyes will be on Apple however and the big question will be “can it keep it up”? Its October report will provide clues as to the direction of the company.

8 top stocks you shouldn’t miss

Apple faces considerable challenges as their global decrease in the demand for laptops, notebooks, tablets, and smartphones. High-interest rates are also curbing global sales of the iPhone 14.

An area that continues to drive growth for Apple is its services business including Apple Music and Apple TV.

Apple by the numbers

So, is it worth trading Apple? Here’s what CMTrading analysis shows:

Analyst consensus: Buy

Forecast: $88.76 billion

Earnings Per Share: $1.26

Market cap: $2.4 trillion

The average price target is $183.37 with a high forecast of $220.00 and a low forecast of $139.

The average price target represents a 22.97% Increase from the last price of $149.12.

Based on 27 analysts offering 12-month price targets for APPLE in the last 3 months

News sentiment:

Analyst consensus: Positive

Based on a formula that combines this week’s News Sentiment and Media Buzz

Amazon – the E-commerce giant

Treat your trading like a business

In 2020, Amazon was well placed to fill the gap caused by pandemic-induced business closures and lockdowns. The company became the primary solution for personal and private section product shipping and racked in billions.

By the end of 2021 however, global lockdowns were lifted and rivals were carving their share of the E-commerce market.

Many analysts aren’t holding their breath for a particularly stellar quarter from Amazon. The company has shown signs of losing growth momentum throughout 2022.

The combination of record-high inflation and high-interest rates has led to consumers and ad companies drastically cutting back on spending. This has damaged Amazon’s bottom line.

The windfall of the pandemic era has ended for e-commerce, as shoppers return to purchasing goods at physical retailers.

Pressured by these challenges, Amazon reported a third consecutive operating loss in July 2022.

With slowing e-commerce sales, Amazon traders are also worried about cost escalation. In 2020, Amazon conducted a massive pandemic-era expansion by acquiring more staff and opening more warehouses globally. Now in 2022, the company’s board is struggling to justify its vast warehouse spaces and inflated paysheet.

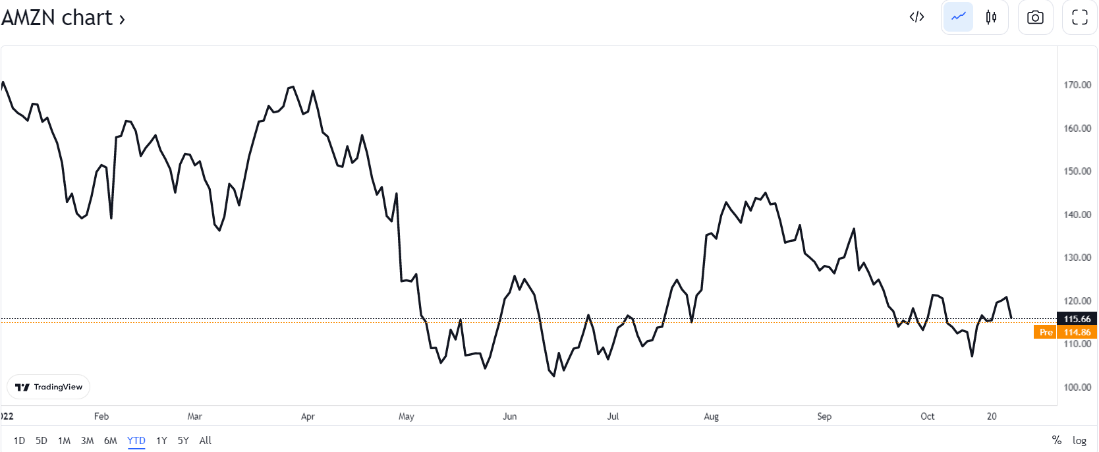

Hurt by these headwinds, AMZN stock is down by more than 30% in 2022, a decline that’s lower than other large-cap tech giants, including Apple and Microsoft.

Amazon by the numbers

Analyst consensus: Buy

Forecast: $127.76 billion

Earnings Per Share: $0.2184

Market cap: $1.8 trillion

The average price target is $170.27 with a high forecast of $200.00 and a low forecast of $118.

The average price target represents a 47.46% Increase from the last price of $115.47

Based on 33 analysts offering 12-month price targets for AMAZON in the last 3 months

News sentiment:

Analyst consensus: Positive

Based on a formula that combines this week’s News Sentiment and Media Buzz

Amazon Web Services – the Silver Lining

While these economic pressures will continue to hurt Amazon, one thing remains for sure – the company is too big to fail. Amazon is adaptable and a prime example of this is the incredible growth of its Amazon Web Services (AWS). Once only a fledging part of its business, AWS has grown to become a big revenue stream for Amazon; revenue for AWS grew 33% in the second quarter of 2022.

Considering its healthy balance sheet, high free cash flows, and highly diversified business model, it’s not difficult to see that Amazon remains in a solid position to withstand the current hostile economic environment.

Final verdict

Amazon stock may show more weakness after its Q3 earnings report. Its slump however shouldn’t deter traders and investors considering the company’s bright future. Given its continual dominance in e-commerce and explosive growth in its cloud and advertising businesses, Amazon is poised to maintain its status as one of the most valuable and profitable companies in the world.

More company earnings are on the way

The October/November earnings season is in full swing and many of the world’s biggest companies are reporting their results creating trading opportunities.

Already, these stocks are causing market volatility, a market state you can’t afford to miss.

Check out the list below for some of the top stocks you shouldn’t miss.

Read about these top stocks:

Tuesday, October 18, 2022

Wednesday, October 19, 2022

Tuesday, October 25, 2022

Wednesday, October 26, 2022

Thursday, October 27, 2022

Apple (AAPL)

Amazon.com (AMZN)

Ready to start trading? Open an account today

Join CMTrading, the largest and best-performing broker in Africa, and discover more opportunities with an award-winning broker. Register here to get started

Follow CMTrading on Facebook, Instagram, LinkedIn, Twitter, and YouTube