Google shares grow 33% year-to-date: are tech stocks still a buy?

The US stock market is going through a rough patch this month, however, the big picture, shows that Google – with its strong year-to-date growth and fundamentals – remains one of the best tech stocks to buy in May.

The surprisingly low job growth and high inflation numbers have triggered a stock market sell-off as investors are anxious about the future performance of growth stocks.

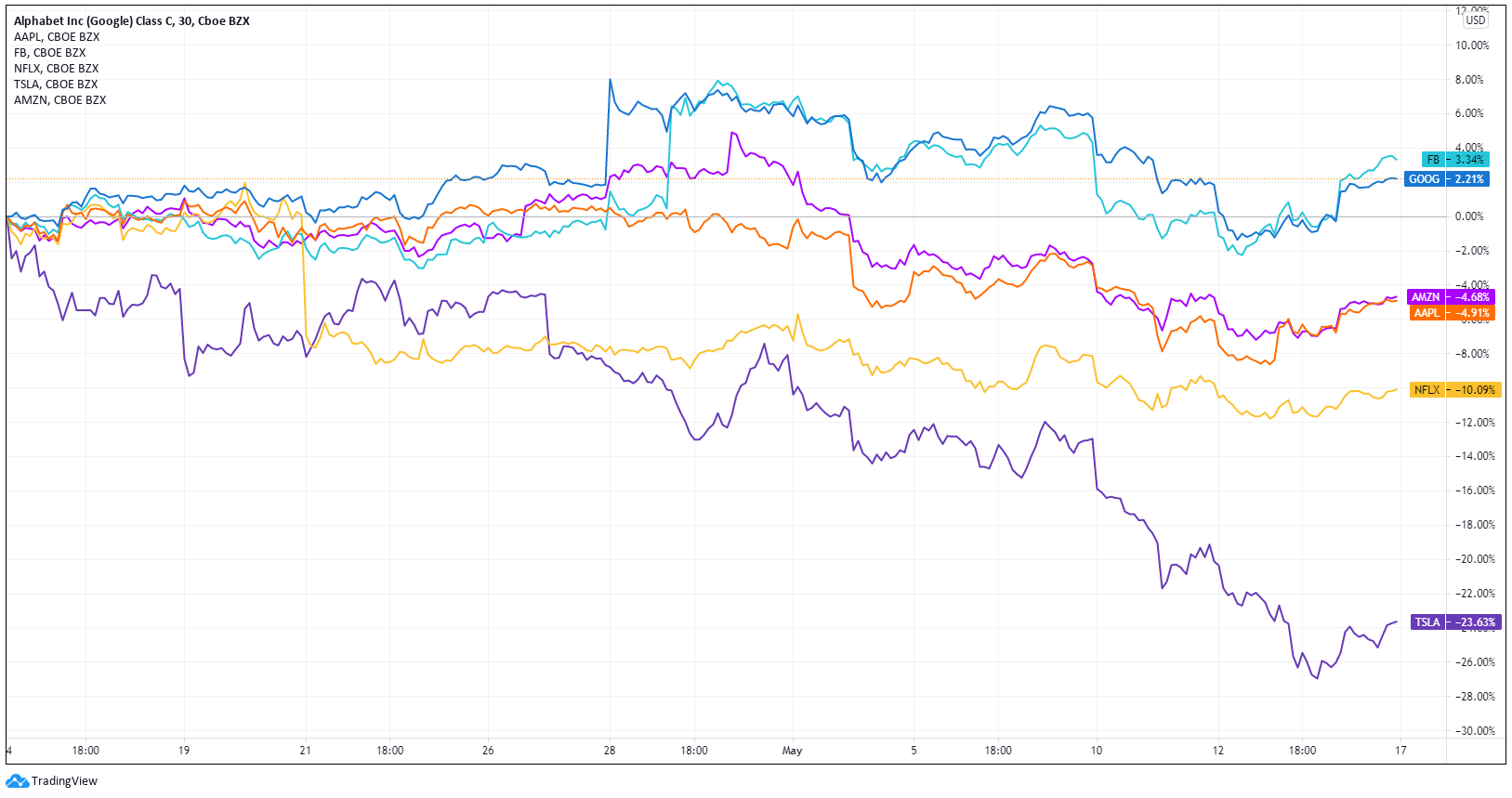

FAANG stocks have taken a hit amid inflation concerns and anxiousness regarding higher interest rates. You can find the monthly performance of FAANG stocks below:

- Facebook: 3.34%

- Apple: -4.91%

- Amazon: -4.68%

- Netflix: -10.09%

- Google: 2.21%

Despite the disappointing short-term performance, however, Google still reigns supreme in the year-to-date range with a growth of 33%, which is far cry from Facebook’s 17% and Amazon’s 1.14%.

In addition, Google’s Q1 earnings report, which was published on the 27th of April also beat analysts’ expectations as EPS (earnings per share) rose to $26,29 compared to the consensus of $15.82.

Revenues also exceeded expectations as the tech giant brought in $55.3 billion thanks to a great performance by YouTube ads and Google Cloud.

The volatility created by a sell-off oftentimes turns into a great buying opportunity. As prices drop, latecomer investors can get into the market at a significant discount as was the case with cryptocurrencies and several other asset classes.

Therefore, it’s important to note that this market downturn is more likely to be short-lived and that patient investors will be able to take advantage of low prices and higher profit potential if enter before the economy corrects itself and the market bounces back to its usual levels.

Discover more opportunities with CMTrading

CMTrading offers more than 150 tradable assets including the top-performing stocks available in the markets. CMTrading clients get access to global brands, exceptional trading conditions and robust safety and security under the auspices of the Financial Sector Conduct Authority (FSCA) in South Africa.

Being a retail brokerage that specializes in CFDs (Contracts for Difference), CMTrading provides clients with unique advantages such as powerful leverage, which allows traders with smaller accounts to gain exposure to much larger positions. This translates to substantially higher profit potential, however, it should be noted that leverage also increases your exposure to downside risk.

While leverage typically adds a certain degree of risk to any investment, CMTrading also offers negative balance protection, thereby guaranteeing that potential losses will never exceed your invested capital.

If you are interested in learning more about how you can take advantage of price movements in stocks, currency exchange rates, commodities or cryptocurrencies, you will find that CMTrading’s unique offering of innovative services and diverse account types are suitable for both beginner and experienced traders.

Start trading the financial markets today with an award-winning broker. Join CMTrading, the largest and best-performing broker in South Africa.

Register here to get started today!