Netflix stock soars: Will the streaming giant end the year on a high note?

Netflix has been Wall Street’s favorite streaming stock for a while now, but the streaming wars are just getting started, as well as the war for more subscribers. Is Netflix positioned to survive the fierce competition?

According to Netflix’s second-quarter earnings report, the company earned $2.97 per share, compared with analysts’ expectations of $3.15. Revenues also came in at $7.34 billion, exceeding analysts’ expectations by 0.6%.

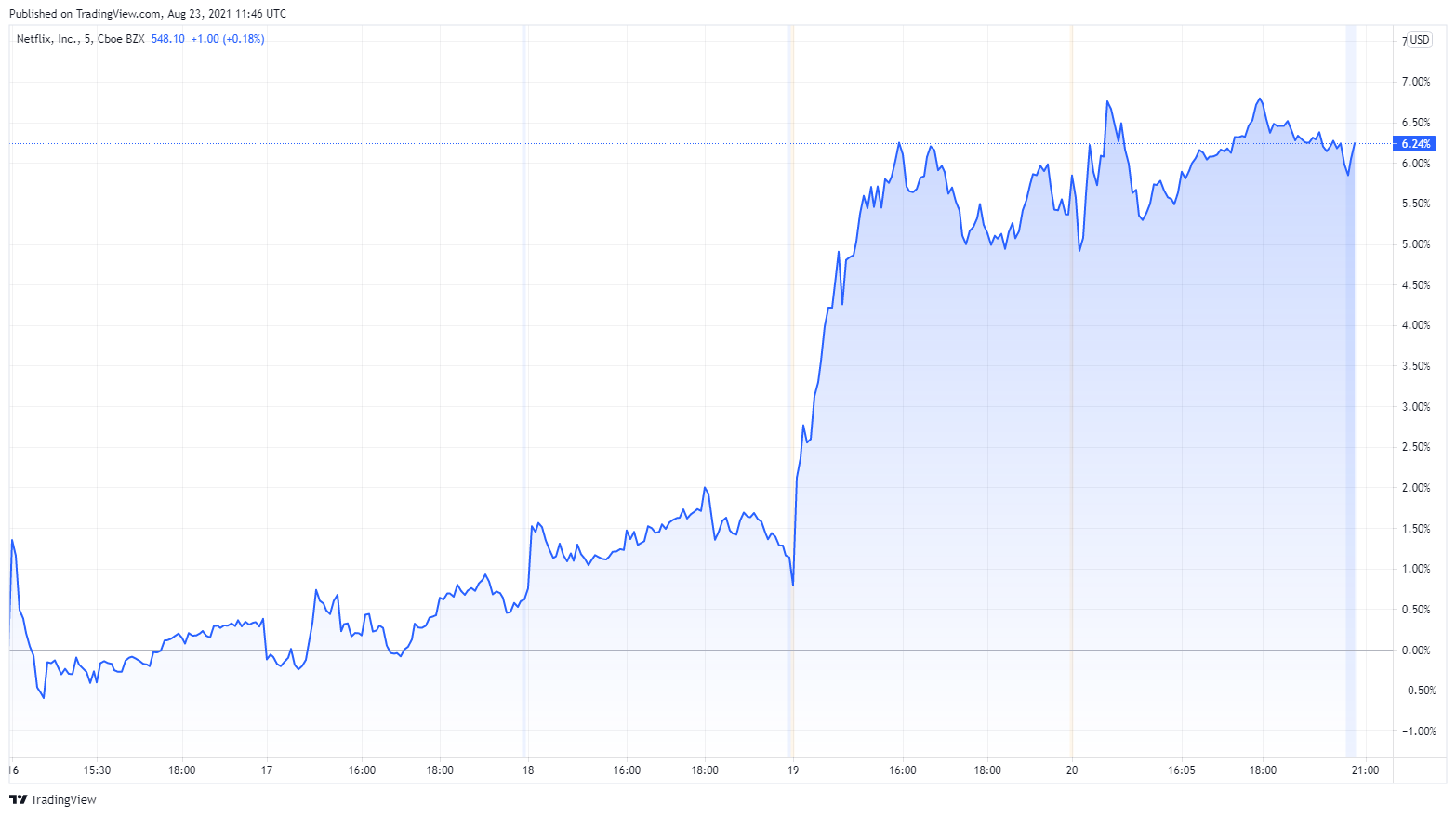

Netflix stocks are now trading at trading at $548 following Thursday’s breakout rally, which saw prices gain 6%.

However, subscriber growth has taken a big hit recently due to competition from the likes of Amazon and Disney as well as pandemic-related delays.

With Disney and Amazon also now competing for their share of subscribers, innovation is becoming increasingly important if Netflix is to maintain its dominance.

Pivoting to video games

Netflix recently announced plans to venture into the world of video games. It is said that Netflix will include games as part of its subscription service free of charge.

In its latest letter to shareholders, Netflix said “We’re also in the early stages of further expanding into games, building on our earlier efforts around interactivity (eg, Black Mirror Bandersnatch) and our Stranger Things games. We view gaming as another new content category for us, similar to our expansion into original films, animation and unscripted TV.”

“Games will be included in members’ Netflix subscription at no additional cost similar to films and series. Initially, we’ll be primarily focused on games for mobile devices. We’re excited as ever about our movies and TV series offering and we expect a long runway of increasing investment and growth across all of our existing content categories, but since we are nearly a decade into our push into original programming, we think the time is right to learn more about how our members value games.”

Discover more opportunities with CMTrading

CMTrading offers more than 150 tradable assets including the top-performing stocks available in the markets. CMTrading clients get access to global brands, exceptional trading conditions and robust safety and security under the auspices of the Financial Sector Conduct Authority (FSCA) in South Africa.

Being a retail brokerage that specializes in CFDs (Contracts for Difference), CMTrading provides clients with unique advantages such as powerful leverage, which allows traders with smaller accounts to gain exposure to much larger positions. This translates to substantially higher profit potential, however, it should be noted that leverage also increases your exposure to downside risk.

While leverage typically adds a certain degree of risk to any investment, CMTrading also offers negative balance protection, thereby guaranteeing that potential losses will never exceed your invested capital.

If you are interested in learning more about how you can take advantage of price movements in stocks, currency exchange rates, commodities or cryptocurrencies, you will find that CMTrading’s unique offering of innovative services and diverse account types are suitable for both beginner and experienced traders.

Start trading the financial markets today with an award-winning broker. Join CMTrading, the largest and best-performing broker in South Africa.